The semiconductor industry is increasingly driven by ICAPS markets – IoT, Communications, Automotive, Power and Sensors – rather than just traditional PCs or servers. Explosive growth in connected devices and EVs means chips packed with RF, power, and sensor functions. Analysts predict nearly 30 billion connected IoT devices by 2027, spanning automotive, industrial, smart-home, wearables and healthcare[1]. These applications demand specialized chips (low-power radios, high-frequency transceivers, mixed-signal ICs) fabricated at diverse nodes. For example, market research shows IoT and automotive IC segments growing at >13% CAGR, reaching over $20–28 B in sales (2017 baseline)[2]. Key technologies now include CMOS logic, BiCMOS, SiGe and even wide-bandgap (SiC/GaN) and piezoelectric materials, across legacy (≫100 nm) to advanced (<7 nm) nodes[2].

Semiconductor Trends Driving IoT, Automotive, and Sensor Technologies

Rapid growth in connected devices, EVs, and sensors is driving demand for RF, power, and MEMS chips, pushing fabs to upgrade equipment, optimize processes, and maintain cleanroom standards.

1. IoT & Communications

Massive networks of sensors and radios (BLE, Wi-Fi, 5G) require ultra-low-power mixed-signal chips. The connected-device count (~30 B by 2027[1]) and expanding 5G networks fuel demand for RF front-end modules and transceivers[3]. This drives equipment upgrades for mid-tier nodes (e.g. enhancing 28–55 nm lines for RF) to boost yield and power efficiency. Our Equipment Engineering services ensure your semiconductor tools are optimized for uptime, precision, and reliable performance, keeping your fab competitive.

2. Automotive & EV Power

Modern vehicles (especially EVs and ADAS) pack 2–3× more chips than gasoline cars[4]. Much of this is power electronics and sensors – roughly 30–40% of auto semis are wide-bandgap power devices[4]. Fabricating SiC or GaN devices requires specialized deposition (e.g. thick epitaxial oxides) and etching tools tailored to hard materials. Advanced driver-assist also uses mmWave radar ICs, demanding sub-100 GHz RF design techniques on silicon. Our Process Engineering expertise helps FABs optimize their process and efficiency by fine-tuning critical steps for advanced automotive and power devices.

3. Sensors & MEMS

Image sensors, accelerometers, gyros, and other MEMS/NEMS devices proliferate in phones, cars, and IoT nodes. These require deep silicon etch (often “Bosch” DRIE processes) and wafer-scale packaging. Even “conventional” CMOS chips now embed MEMS and analog sensors (capacitive touch, pressure, IR, etc). As one report notes, IoT devices blend analog-to-digital circuitry, RF chips, power modules and sensors to “sense the analog world”[1], imposing new process integration challenges. With our FAB Facility Services, we help FABs maintain world-class cleanroom environments and infrastructure to support complex MEMS and sensor manufacturing.

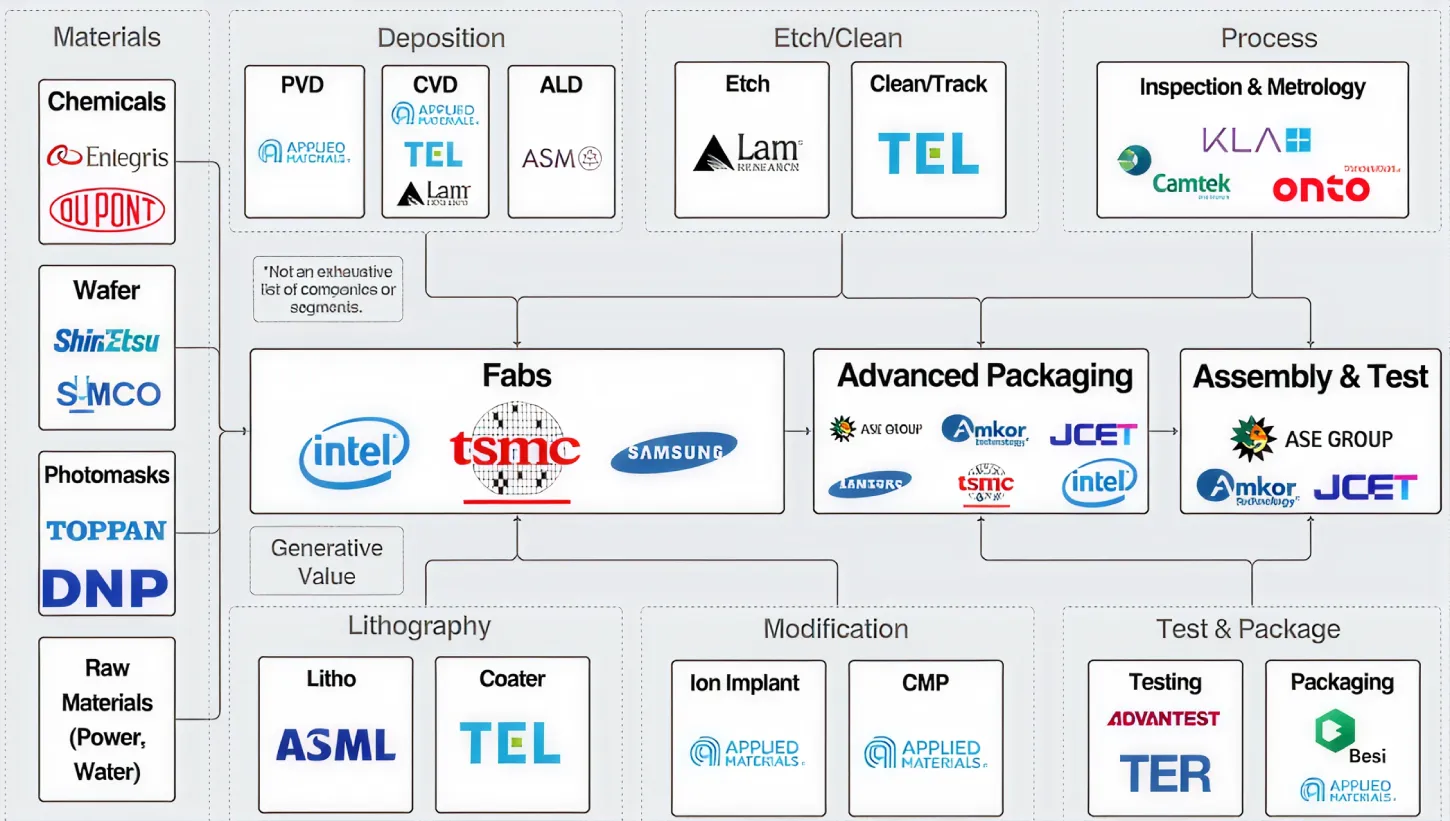

Together, these ICAPS trends are driving equipment innovation. For example, fabs are adapting 300 mm tools to cost-effectively run mature nodes for IoT/auto chips[2], and introducing new materials (high-k dielectrics, metal gates, SiC epitaxy) to meet power/sensor specs. In short, semicon equipment must support multi-dimensional innovation – not just scaling transistors, but new architectures and materials[1].

RF Circuit Design in ICAPS Chips

Radio-frequency (RF) circuit design is central to ICAPS applications. RF design involves creating systems and components (amplifiers, filters, mixers, antennas) that operate at high frequencies[5]. In practice this means integrating complex front-ends (e.g. 5G transceivers, Bluetooth radios, radar PAs) on silicon or compound substrates. The RF semiconductor market reflects this growth – projected from $25.7 B in 2024 to $41.6 B by 2030 – powered by 5G rollouts, IoT connectivity and automotive radar[3]. For instance, global RF chip forecasts highlight 5G, satellite comms and vehicle radar as key drivers, making RF components “increasingly indispensable” in both consumer and industrial devices[3].

Connecting billions of devices requires advanced RF SoC design. Low-noise amplifiers, phase shifters, and antenna tuners must be co-designed with digital logic. To keep battery life long, many IoT RF chips leverage analog/mixed-signal tweaks on mature nodes (e.g. 28–55 nm). Indeed, to meet IoT demands, “RF-optimized versions” of standard processes (28/22/16 nm) are being developed, enabling lower-power BLE and LoRa radios[1]. In automotive, RF expertise is key for radar/LiDAR: silicon GaAs or SiGe processes are used to achieve the necessary frequency and linearity.

RF design techniques also influence equipment needs. High-frequency analog often requires different BEOL (back-end-of-line) materials (low-loss dielectrics, thick copper) and precise analog doping; these push equipment vendors to provide new tool recipes (for example, deep trench isolation steps or additional metal layers). Meanwhile, the sheer volume of RF IoT chips demands high-throughput etch/deposition tools. In sum, RF circuits are not just a chip concern – they drive equipment evolution tool[1].

RF-Driven Fabrication Processes

Many critical fabrication steps themselves rely on RF energy. In etching and deposition, RF-powered plasmas enable fine control at the nano-scale. For example, semiconductor chambers use a plasma(ionized gas) to etch or deposit films, with RF generators supplying the energy. As one review explains, inside a process chamber “partially ionized gas, called plasma is used to accomplish deposition, etching, and cleaning,” and “the generation and sustaining of a plasma is possible with RF energy”[6]. In practice, RF sources (often 13.56 MHz or 27.12 MHz) are coupled into a chamber through a matching network, energizing gas molecules so they react with the wafer surface. The level and purity of this RF power critically affect uniformity and selectivity: “RF energy applied carry great importance to accomplish selective wafer processing including uniformity, etch rate, anisotropy”[6].

Key RF-driven processes include:

1. Atomic Layer Deposition (ALD)

An ultra-precise CVD method depositing films one atomic layer at a time. ALD’s self-limiting pulses yield conformal, ultra-thin coatings(e.g. gate oxides, high-κ dielectrics) critical for nanoscale devices[7]. ALD chambers often use plasma (RF bias) steps to clean surfaces between pulses.

2. Plasma-Enhanced CVD (PECVD)

Uses an RF-powered plasma to activate film deposition at lower temperatures. For example, PECVD silicon dioxide or nitride films are formed by dissociating silane/other precursors with RF energy[7]. This enables high-quality insulators on temperature-sensitive substrates.

3. Reactive Ion Etching (RIE)

A dry etch combining chemical reactions and ion bombardment under RF plasma. RIE “uses reactive gases in a plasma state to chemically and physically remove material” with high resolution and anisotropy[8]. The RF bias accelerates ions vertically, producing directional (anisotropic) etch profiles – essential for tight patterning. As one technical guide notes, RIE’s ion bombardment yields sharp, well-defined features with minimal undercutting. In practice, many RIE systems operate at 13.56 MHz RF[8].

4. Inductively Coupled Plasma (ICP) Etch

Uses an RF coil to inductively couple energy into the chamber, creating a high-density plasma. ICP tools (often combined with RIE bias) are used for deep or high-aspect-ratio etches, such as MEMS trenches or through-silicon vias. These rely on RF power both in the coil and the substrate bias[8].

5. Physical Vapor Deposition (PVD)

Sputtering processes for metal or dielectric layers. While many PVD systems use DC for conductive targets, sputtering insulators (like silicon oxide) may use RF power. RF sputtering sources are a variant of RF power delivering ions to knock material onto the wafer[7].

In all these tools, RF generators and matching networks are critical subsystems[6]. The RF frequency and power level determine ion energy and density, affecting etch rate and film quality. For instance, high RF bias enhances anisotropy in RIE, while high-density RF plasma (e.g. 2–4 MHz in ICP) boosts etch throughput. Equipment engineers must therefore design RF delivery for low noise and stable impedance, since “spurious and harmonics levels” must be tightly controlled in chip fabrication[6]. In short, RF is a core enabler of modern wafer processes, from depositing atomic-layer films to etching sub-20 nm features[8].

India’s Emerging Role

Globally, countries are expanding semiconductor efforts, and India is positioning itself as an emerging hub. The Indian government’s $10 billion Semiconductor Mission aims to establish local chip fabs, package/test facilities and R&D[9]. Under this program and initiatives like “Make in India”, incentives are offered to attract international manufacturers and develop domestic start-ups[9]. Progress includes funding new wafer fabs and packaging units, with a long-term goal to reduce reliance on imports.

India’s focus aligns with its industry strengths and needs. Analysts highlight the rollout of 5G networks(by carriers like Jio/Airtel) and a booming EV sector as key market drivers[9]. For example, the growth of EVs in India (and worldwide) sharply increases demand for automotive semis (sensors, controllers, power ICs)[4]. Similarly, smart city and IoT initiatives (in healthcare, agriculture, energy) fuel specialized chips. India-Briefing notes that 5G/telecom, automotive/EV and IoT are “key trends shaping India’s semiconductor market,” each spurring demand for high-performance chips[9]. In practice, India expects its electronics market (smartphones, IoT devices) to reach hundreds of billions of dollars in the next few years, requiring a robust supply chain. Our Engineering & Product Management Services help semiconductor manufacturers reduce costs, enhance product reliability, and accelerate time-to-market by combining advanced engineering solutions with strategic product oversight.

Ultimately, India’s emerging ecosystem, supported by government policy and a large electronics industry, offers new volume and innovation opportunities. Local fabs and design houses will demand advanced equipment for ICAPS technologies (e.g. tools for RF front-ends, MEMS sensors, power devices). Distributor partnerships and research centers are also helping bridge global semiconductor knowledge into India’s market. While challenges remain (building human expertise, supply chain), the combination of policy support and market growth means India will increasingly be part of the global chipmaking story[9].

In summary, the ICAPS wave is transforming the fab floor. IoT, comms, auto, power and sensor end-markets now dictate new chip architectures and materials, and RF technologies sit at the nexus of these changes. RF circuit design empowers connectivity and sensing on chips, while RF-powered plasmas enable the precise etching and deposition of next-gen devices[5]. For equipment engineers and process experts, staying ahead means innovating in RF delivery, plasma control and materials integration to meet the demands of this diverse, high-growth semiconductor landscape.

With 15+ years of expertise and a global team of 500+ engineers, Orbit & Skyline is a trusted partner in the semiconductor industry. If you are looking for a semiconductor services and solution partner, reach out to us at hello@orbitskyline.com.

References

Recent industry analyses and technical reviews on ICAPS markets, RF semiconductor growth[1], RF circuit design[5], plasma and deposition processes[8], and India’s semiconductor initiatives[9].

- [1] What’s Driving the Need for Innovation in ICAPS? https://www.appliedmaterials.com/us/en/newsroom/perspectives/whats-driving-the-need-for-innovation-in-icaps.html

- [2] Leveraging 300 mm Technologies at 200 mm for IoT and Automotivehttps://newsroom.lamresearch.com/Leveraging-300-mm-Technologies-at-200-mm-for-IoT-and-Automotive

- [3] RF Semiconductor Market Size ($41.6Billion) 2030https://www.strategicmarketresearch.com/market-report/rf-semiconductor-market

- [4] Automotive Semiconductor Demand: How EVs Are Driving Chip Market Growth | PatentPC https://patentpc.com/blog/automotive-semiconductor-demand-how-evs-are-driving-chip-market-growth

- [5] RF Design Software Market, Report Size, Worth, Revenue, Growth, Industry Value, Share 2024https://reports.valuates.com/market-reports/QYRE-Auto-37P18173/global-rf-design-software

- [6] Mwjournalmwj201312 DL | PDF | Telecommunications | Telecommunications Engineeringhttps://www.scribd.com/document/200069881/Mwjournalmwj201312-Dl

- [7] The Role of Plasma Technology and Deposition Techniques in Semiconductor Manufacturing – RFHIChttps://rfhic.com/industries-rf-energy/industrial/the-role-of-plasma-technology-and-deposition-techniques-in-semiconductor-manufacturing/

- [8] Reactive Ion Etching: A Comprehensive Guidehttps://www.wevolver.com/article/reactive-ion-etching

- [9] India’s Emerging Semiconductor Ecosystem: Key Players

https://www.india-briefing.com/news/india-emerging-semiconductor-ecosystem-key-players-34506.html